Drink Different: The Bold Beverage Trends Taking Over 2026

As we enter 2026, the global beverage landscape is undergoing a profound transformation. The “viral” era of fleeting ads is being replaced by a more grounded, intentional approach to what we consume.

From the “Body OS” movement to the rise of nostalgia, here are the key trends defining how the world will drink this year.

The “Body OS” and Personalized Functionality

While protein was the undisputed king of 2024 and 2025, 2026 is officially the year of fiber. Driven by the mainstream rise of GLP-1 medications and a deepening understanding of gut health, consumers are treating their bodies like operating systems that require specific “upgrades.”

We are seeing a surge in “protein-ification” and “fiber-maxxing” across unexpected categories — think high-fiber cocktail mixers and probiotic-enriched pastas. The focus has shifted from “what to avoid” (sugar, gluten) to “what to add” (bioactive compounds, prebiotics, and adaptogens) to optimize daily performance and long-term longevity.

Consumers may also move on from specific goals of “maxxing,” or the viral advice to consume high amounts of protein or fiber each day, to adopt inclusive diets that celebrate the functional benefits of consuming a diverse variety of ingredients.

Protein Gains Traction in the Beverage Sector

The beverage sector will see the rising trend of “proteinization” with protein added to a wide range of drinks. Once limited to nutritional shakes, meal replacements, and fitness drinks, high/added protein claims are gaining traction across more drinks.

Ready-to-drink (RTD) coffee and flavored water will lead, with RTD tea and carbonated soft drinks following. This shift reflects consumers’ rising demand for convenient, enjoyable sources of protein (regardless of any “processing” that is necessary to fortify otherwise natural beverages). Improving protein taste is key to driving broader adoption. Just as RTD coffee successfully masks protein’s flavor, other beverages will leverage distinct taste profiles and textures like carbonation to make protein-rich options more appealing.

Eventually, to meet consumers’ evolving wellness priorities, high/added protein claims will become more mainstream in drinks, alongside gut health and immunity benefits.

Variety wins: Consumers are moving past “one‑nutrient” drinks. By 2030, they’ll look for flavor and ingredient diversity—think hibiscus, tamarind, barley tea, kefir, botanicals, and global fruit blends — making variety the new signal of a healthier beverage choice.

Gut health goes mainstream for families: Parents will seek kid‑friendly microbiome support in drinks: low‑sugar prebiotic juices, cultured dairy/kefir smoothies, and gentle, bacteria‑boosting options. Brands that teach “feeding good bacteria” and keep labels simple will win trust.

Fiber becomes everyday protection: Expect fiber‑forward formats — soluble‑fiber waters, fiber‑enriched smoothies and mixers — to be framed as daily defence for modern lifestyles, tapping emerging evidence on fiber’s role in offsetting environmental stressors.

Heritage Ingredients and a Desire for Nostalgia

Drinks rooted in nostalgia and trusted traditions help consumers feel more grounded in an increasingly volatile, tech‑driven world. As AI accelerates formulation, brands are rediscovering the power of tradition — brewing cascara like our grandparents did, layering botanical bitters from apothecary lore, and fermenting whey into lively sodas. The result is modern convenience built on heritage ingredients that consumers already trust.

For Gen Z, beverages are about more than taste — they’re about connection, place, and the stories behind each sip. UK Gen Z drinkers are especially drawn to culturally authentic spirits like Soltol. Meanwhile, artisanal, heritage‑inspired hot drinks are rising in popularity as consumers look for more than a quick caffeine fix; they want a meaningful, intentional start to their day.

The Rise of Zero-Alcohol Beverages

Once considered niche, zero-alcohol beverages have become a mainstream choice for consumers seeking wellness, moderation, and sophistication. Consumers are increasingly prioritizing physical and mental health. In fact, 40% of those choosing no-alcohol spirits cite a healthy lifestyle as their main motivation. Gen Z and Millennials are leading the charge, with alcohol consumption among Gen Z declining by 25% over the past four years.

The “sober curious” movement has evolved into a commercial powerhouse, redefining social occasions with concepts like “soft clubbing” and coffee-based happy hours.

Mocktails Gain Popularity, But Traditional Soft Drinks Are Still Winning

There is a growing market for sophisticated non-alcoholic drinks that mimic the experience and flavors of alcoholic beverages. Brands are innovating with alcohol-inspired flavors, premium packaging, and collaborations with bartenders to deliver elevated taste experiences. However, while mocktails and non-alcoholic versions of alcoholic drinks are gaining popularity, traditional soft drinks, sparkling water, and tea remain the most common alcohol substitutes, largely due to their accessibility and perceived value.

The premium price of alcohol-free alternatives to alcoholic drinks likely compels people to drink water and soda instead. Over half (52%) of US alcohol drinkers claim that non-alcoholic versions of alcoholic drinks are not worth the price. In the UK and Germany, usage declines among the less well-off.

Market Momentum:

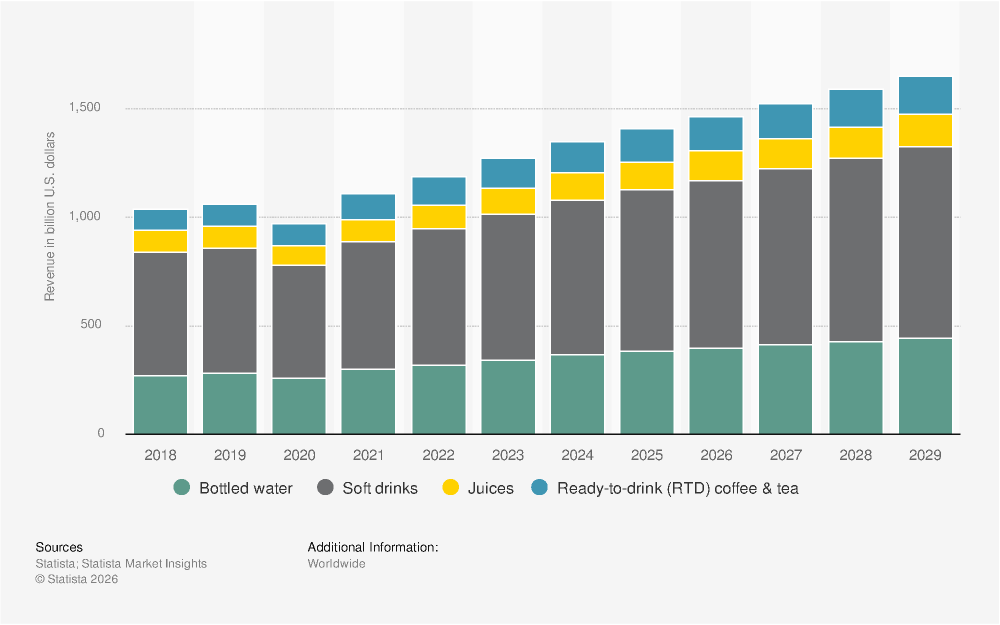

- The global non-alcoholic beverage market is projected to surpass $157 billion by the end of 2026.

- No-alcohol alternatives (beer, wine, spirits, RTDs) are forecast to grow by 50% in volume between 2025 and 2030.

Revenue in the non-alcoholic drinks market worldwide from 2018 to 2029, by segment (in billion U.S. dollars)

Today’s zero-alcohol drinks go beyond “what’s missing” to deliver functional benefits and indulgent flavors. From adaptogen-infused sparkling teas to nostalgic dessert-inspired mocktails, brands are merging wellness with emotional connection. Functional beverages offering gut health, mood enhancement, and hydration optimization are booming, with the prebiotic soda market alone projected to reach $766 million by 2030.

- 92% of non-alcohol buyers also purchase alcoholic products, signaling that this trend is about choice and flexibility, not abstinence.

Flavor Trends to Watch

Non-alcoholic drink flavors are evolving into expressions of personal identity, cultural heritage , and holistic health. Flavor trends are also being shaped by mindful drinking, wellness-driven choices, bold taste profiles and the rise of viral flavors.

- 30% of US restaurant-goers want spicy flavors in non-alcoholic drinks.

- 100% of the wood fiber used in our paperboard manufacturing process is certified as sustainably sourced, and 96% of our facilities are certified to one or more fiber certification standards.

According to Mintel’s “Flavourscape AI”, emerging flavors include cream, cherry, punch, tropical, caramel, and passionfruit/maracuja. Declining flavors include cola, kombucha, cranberry, blueberry, coconut, and mint.

From “Sustainable” to “Circular”

The industry is shifting toward circular processing, where “waste” from one product becomes the hero ingredient of another. Consumers will gain respect for resourcefulness, which will once again make upcycling genuinely innovative thanks to products that offer new experiences.

Examples include:

- Coffee cherry husk (cascara) → teas & sparkling sodas: The fruit around the coffee bean brews into aromatic teas or lightly sparkling sodas with dried‑fruit notes.

- Fruit peel & zest → botanical tonics & bitters: Citrus peels and herb stems head into zero‑waste tonics, syrups, and bitters, elevating low/no‑alcohol choices.

- Cheesemaking whey → fermented sodas & protein waters: The liquid whey left from cheese or yogurt can be fermented into lively, lightly tangy sodas or clarified and blended to make clear protein waters, cutting sugar while adding functionality.

Sensory-First Experiences

Multisensory beverages are evolving from playful novelties to practical, memorable experiences tailored to diverse sensory needs. Brands are now strategically using color, texture, and aroma to enhance drinking and brand identity, driving competition and differentiation. Unexpected scents and textures are being used to energize and build anticipation.

Examples include:

- pH‑reactive “color‑shift” botanicals in RTD teas/lemonades: Butterfly‑pea‑flower or similar botanicals shift from blue to pink/purple with citrus. The visible transformation builds theater at first sip and signals freshness/fruit content (no extra sugar required).

- Dual‑phase or layered drinks: Clear‑over‑cloudy layers (e.g., clarified juice over a pulpy base) that consumers mix at the table; the visual “merge” moment doubles as a micro‑ritual and reinforces “made‑for‑me” positioning.

- Nitro cascade for coffee/tea and functional sodas: The waterfall micro‑bubble effect is a built‑in, repeatable spectacle that also softens perceived bitterness — useful for botanicals.

Advances in materials science and digital printing are also making packaging more interactive, with features like peelable snack layers, scent-enabled bottle reuse, audio prompts, and tactile designs inspired by beauty brands becoming more common.

References:

- Mintel. 2026 Global Food & Drink Predictions.

- CaterSource. (2026). A Taste of Tomorrow: The Trends That Will Rule 2026

- Mintel. (2025). Zero alcohol drinks and consumer-behavior

- Forbes. (2026)The rise of sober-curious Gen-Z

- Grand View Research. (2025) Industry Analysis Prebiotic Soda-Market Report

Packaging is a tangible and highly visible product, and it’s understandable that people want to know where it comes from. But facts matter — and the facts show that the paperboard industry is not the driver of forest loss.

If anything, with responsible practices and expertise at the forefront, it’s part of the solution, keeping forests in active use, encouraging land stewardship, and maintaining critical carbon sinks.

To learn more about our “Better, Every Day” approach to sustainability, visit our sustainability area to explore our commitments in full.