article

Packaging Reimagined: Crafting Tomorrow’s Sustainable Solutions

Where packaging designed for sustainability once offered a competitive advantage for brands, today it’s simply expected. With legislation such as the EU’s Packaging and Packaging Waste Regulation (PPWR) and Extended Producer Responsibility (EPR) influencing brand and retailer priorities, packaging decisions are a key driver of compliance, reputation, and market success.

For businesses, conversations around packaging sustainability are moving beyond material choice alone to encompass the full product life cycle, carbon footprint, material circularity, renewable content, and future readiness. As complexity grows, “paperisation” is taking centre stage as a strategy that provides many positive answers.

What do we mean by “sustainable packaging”?

Sustainable packaging isn’t about one attribute or one material; it’s a multi-dimensional concept. It refers to packaging solutions that minimise environmental impact across their entire lifecycle, from sourcing and production to use and end-of-life. It includes using responsibly sourced renewable or recycled content, reducing material use, and designing for reuse or recyclability.

The International Organization for Standardization (ISO) defines sustainable packaging as “Meeting consumers’ needs for product protection, safety, handling, and information, while also efficiently using resources and limiting environmental impact”. That means sustainability must be measured holistically, not just by a single metric in isolation. Issues such as plastic pollution, carbon footprint, resource scarcity, and circularity all play a part. In other words, packaging sustainability requires connected thinking, balancing competing priorities and optimising performance across multiple impact areas.

The changing language of sustainability: From claims to credibility

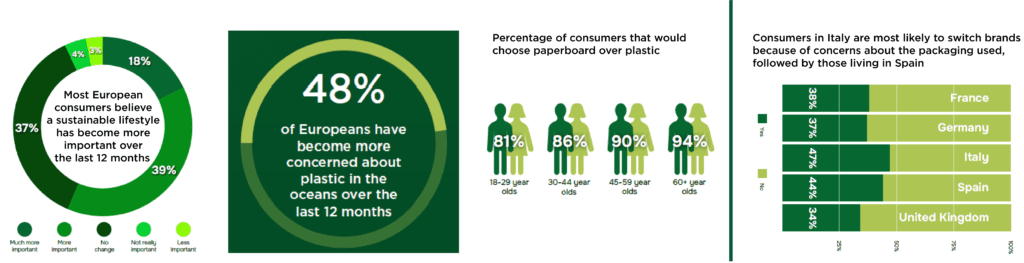

One of the most interesting aspects of sustainability is the rise in consumer awareness. The latest Pro Carton study on European consumer attitudes shows that 57% of respondents believe a sustainable lifestyle has become more important over the last 12 months, while 48% have become more concerned about plastics in the oceans. Across Europe, paperboard is preferred by 86% of consumers versus plastic packaging, and on average, 40% of consumers across Europe have switched brands or products because of concerns about packaging.

Alongside this growing awareness, however, greenwashing, where sustainability claims are distorted, exaggerated, or misrepresented, is a growing challenge. In response, the UK’s Green Claims Code and the EU’s Green Claims Directive bring in a new era of environmental communication, one that demands clarity, accuracy, and accountability. These initiatives aren’t advisory notes or guidance; they’re rulebooks. In the UK, enforcement of the Green Claims Code can mean fines of up to 10% of a company’s annual turnover. In the EU, it can be over 4% of global company revenue per breach. These are high stakes for every claim that goes on packaging, into press releases, or across marketing channels. This isn’t about silencing sustainability stories; it’s about telling them better, more transparently, and more honestly.

If a pack is recyclable, where is the evidence, and can it be demonstrated in practice and at scale? If a material has a lower carbon footprint than another material compared to which baseline, and based on which assumptions? If it has to be free of a substance or meet a specific standard by law, this should not be claimed as a benefit. Empty, incorrect, and vague claims erode trust, but well-evidenced ones can elevate reputation and credibility.

In a market where claims need to be compliant, packaging partners should be a strategic partner, not just a supplier. In this way, both parties are invested in providing accurate, relevant, and meaningful claims.

What’s driving the move to more sustainable packaging solutions?

Brands and retailers are under pressure to meet their sustainability goals, such as 100% recyclable packaging, reduced use of virgin plastic by a set %, or reduced emissions by 2030.

Paperboard packaging is naturally aligned with these ambitions. It’s typically recyclable in household waste streams, made primarily from renewable and/or recycled materials, and can be optimised through smart structural design to minimise material use and weight.

For brands and retailers though, it’s also about giving their consumers what they want, and as we saw from Pro Carton’s recent study, what they want is paperboard over plastic.

In terms of legislation, the EU’s Packaging and Packaging Waste Regulation (PPWR) is a significant shift in packaging law, introducing mandatory design for recycling (DfR) criteria, caps on empty space in packaging, and targets for reuse and recycled content, among others. Although certain exemptions apply, the PPWR will cover most forms of consumer packaging produced and sold in the EU or imported to the EU.

The Extended Producer Responsibility (EPR) initiative has added cost and complexity to packaging decisions. Under EPR, producers are financially responsible for the end-of-life management of the packaging they place on the market. Materials that are more challenging to collect, sort, and recycle will have higher compliance fees. The plastic tax in place in the UK and Spain is another instrument that attempts to compensate for the linear economy of plastic.

Together, these drivers create a powerful incentive to act. Businesses need packaging that performs on-shelf and in supply chains, while also ticking boxes for legislation, sustainability, and consumer appeal.

Enhancing sustainability with paperboard packaging

With intelligent structural design and material selection, paperboard can enhance sustainability for a wide range of packaging applications.

Recyclability

Paperboard packaging is one of the most highly recycled materials in the world, with a recovery rate of 83% in Europe. In contrast, the recovery rate for plastic packaging is 41%, and it’s just 25% for PET trays and 21% for plastic films.

Carbon footprint

Even though the carbon footprint of packaging is only one of its environmental impacts, it’s generally one of the most important aspects for packaging buyers, especially those who have committed to science-based decarbonisation or net-zero targets. For paperboard packaging, the biggest contributor to its carbon footprint lies in the raw materials consumed at the paperboard manufacturing plant stage of production. Selecting materials that support lightweighting and minimised design, and/or the lowest carbon-intensive materials (e.g., replacing fossil-derived materials), is key to minimising carbon footprint.

Material circularity

When it comes to packaging, alongside evaluating carbon footprint, it’s important to consider material circularity. The Material Circularity Indicator (MCI), developed by the Ellen MacArthur Foundation, offers a valuable methodology. It takes into account the recycling rate and efficiency, and considers how effectively materials can be recycled and reused in multiple loops. The MCI for paperboard packaging is generally much more favourable than plastic. An MCI of one is a fully circular pack. An MCI of zero is a fully linear pack. To illustrate, the MCI of EnviroClip™ Bottles, a minimal-material, clip-style multipack carton for PET bottles, has an MCI of 0.888, while the shrink wrap it replaces has an MCI of just 0.154.

Minimising food waste

Externally published studies confirm that the global warming potential and resources embedded in the packaging are lower (in the range of 3-5% in general) than those related to the packed products themselves. Paperboard packaging with an effective barrier maintains – and in some cases enhances – the shelf-life of food. Take a look at the example of our own ProducePack™ Punnet tray below.

The versatility of paperboard: Real-world examples

PaperSeal™ Shape

UK retailer Sainsbury’s transitioned to our PaperSeal™ Shape paperboard tray for their breaded chicken range from plastic, reducing plastic content by up to 82% versus the previous plastic tray. This switch removes more than 300 tonnes of plastic from their supply chain each year.

The tray is recyclable according to OPRL guidelines in the UK without the need to remove the barrier liner.

Pressed Board Trays

UK retailer Morrisons transitioned from plastic to pressed paperboard trays reduced plastic use by 90% per tray and resulted in the elimination of 250 tonnes of plastic every year.

ProducePack™ Punnet Tray

Our paperboard punnet tray is recyclable in household waste streams under OPRL guidance and certain configurations can be classified as plastic-free according to the SUPD.

Independent testing conducted by Washington State University showed tomatoes have a longer shelf-life in the paperboard punnet than those in plastic. The paperboard’s permeability, combined with the punnet tray’s ventilation holes, allowed moisture and gases to escape, resulting in lower relative humidity. Condensation did not form on the tomatoes in these punnets, which likely explains why mold growth was slower and significantly less on these tomatoes than on the ones packed in plastic. This is an essential aspect of packaging functionality that has the potential to limit waste at retail and at consumer levels. Furthermore, the punnet tray has been shown to have a lower climate impact than plastic trays via cradle-to-gate LCA analysis.

CleanClose™ Child-Resistant Detergent Pack

Developed initially for Unilever, this child-resistant laundry detergent carton replaces plastic tubs and bags with an alternative made from paperboard. The packaging can be recycled after use and features a child-safe opening mechanism that is also intuitive for adults to operate.

Boardio™

The Boardio™ pack for confectionery giant Perfetti Van Melle is the first product in the gum category to be delivered to market in a paperboard tub, replacing the previous rigid plastic container. Boardio is recyclable in household waste streams.

KeelClip™

Liberty Coca-Cola Beverage’s switch to KeelClip™ replaced plastic rings on multipacks of mini cans with a recyclable clip-style paperboard alternative, eliminating an estimated 37.5 tonnes of plastic annually.

Sushi Trays

Our sushi packaging portfolio includes options that meet the EU Single-Use Plastic Directive (SUPD) definition of ‘plastic free’, alongside solutions containing no plastic lamination or less than five percent plastic.

All formats can be designed to be recyclable in European household waste streams.

Why act now?

Delaying action is not a neutral choice. With full EPR implementation, and PPWR enforcement timelines approaching, businesses that wait may find themselves out of step with regulations, potentially seeing unexpectedly higher fees. More importantly, they risk falling behind in a fast-evolving market where sustainability is no longer a differentiator, but a baseline expectation.

With rising consumer demand, sustainability isn’t a future challenge, it’s a present imperative. The businesses that understand this, and build it into their packaging strategy, are primed to win tomorrow’s shelf space.

Let’s build better packaging, together

We partner with global, national and regional brands, private label manufacturers, and retailers to develop paperboard packaging solutions that perform for them, their consumers, and our planet.

Whether you’re rethinking one SKU or your entire packaging portfolio, we’re ready to help you transition to better packaging.